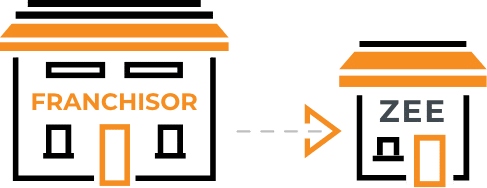

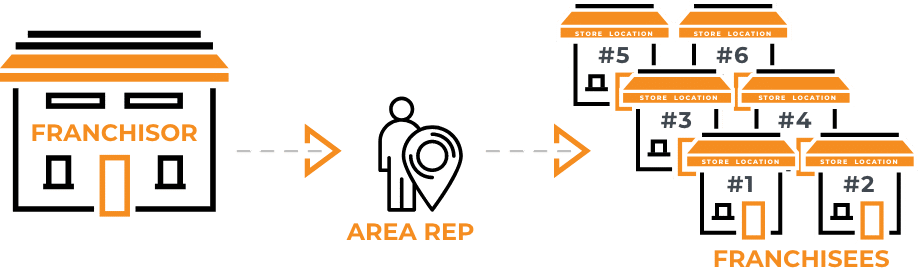

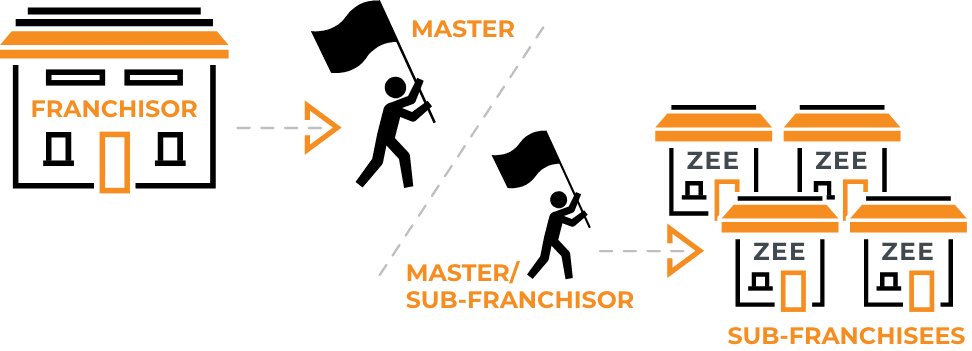

Franchising is a business unto itself. When someone decides to franchise their business they are really starting a brand new business. The business of franchising is selling your business model to others and sharing in their success. As a franchisor, your job is to be the coach, mentor and leader of the new system.

Because of the financial risk of starting a new business, and the potential for your franchisees to pay you money while losing money themselves, the government regulates the sale of franchises. At the federal level, franchising is regulated by the Federal Trade Commission (the “FTC”) and by various state regulatory agencies in a handful of states. As a franchisor, it is your responsibility to comply with both federal and state law. If you don’t, at best you will have a franchise agreement you can’t enforce and at worst you will lose control of your intellectual property and may be held responsible for the financial losses of your franchisees. The rules on their surface are designed to protect franchisees by leveling the information playing field, but in reality the rules protect the franchisor by enabling the franchisor to have a valid, enforceable agreement and to separate the risk of the unit from the financials of the franchisor.

In very broad terms, no matter what you call yourself, you are considered a franchise if you:

- Allow someone to use your name/trademark

- Charge them a fee

- Assist, control or advise them on the operation of the business

As you can see, it is very hard to not pass this test if you allow others to open a similar business under your name and you charge them for it. Many businesses try to “license” their operation to others when in reality they have created an illegal franchise. It’s illegal because they are considered a franchise, even if they call themselves a license, and they didn’t comply with the FTC or relevant state rules. Now they will be bearing risk that they were not compensated for, so it’s a very bad idea.

The franchise rules are not overly complex or burdensome if you have the right advisors, however the punishment for not following them can be punitive. Therefore, our advice is always to just wait to franchise your business for when you can invest both the time and money to do it right.